Superconducting Qubits Research Market Report 2025: In-Depth Analysis of Technology Advancements, Market Dynamics, and Global Growth Projections. Explore Key Players, Regional Trends, and Strategic Opportunities Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Superconducting Qubits (2025–2030)

- Competitive Landscape and Leading Players

- Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

- Regional Market Analysis: North America, Europe, Asia-Pacific & Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

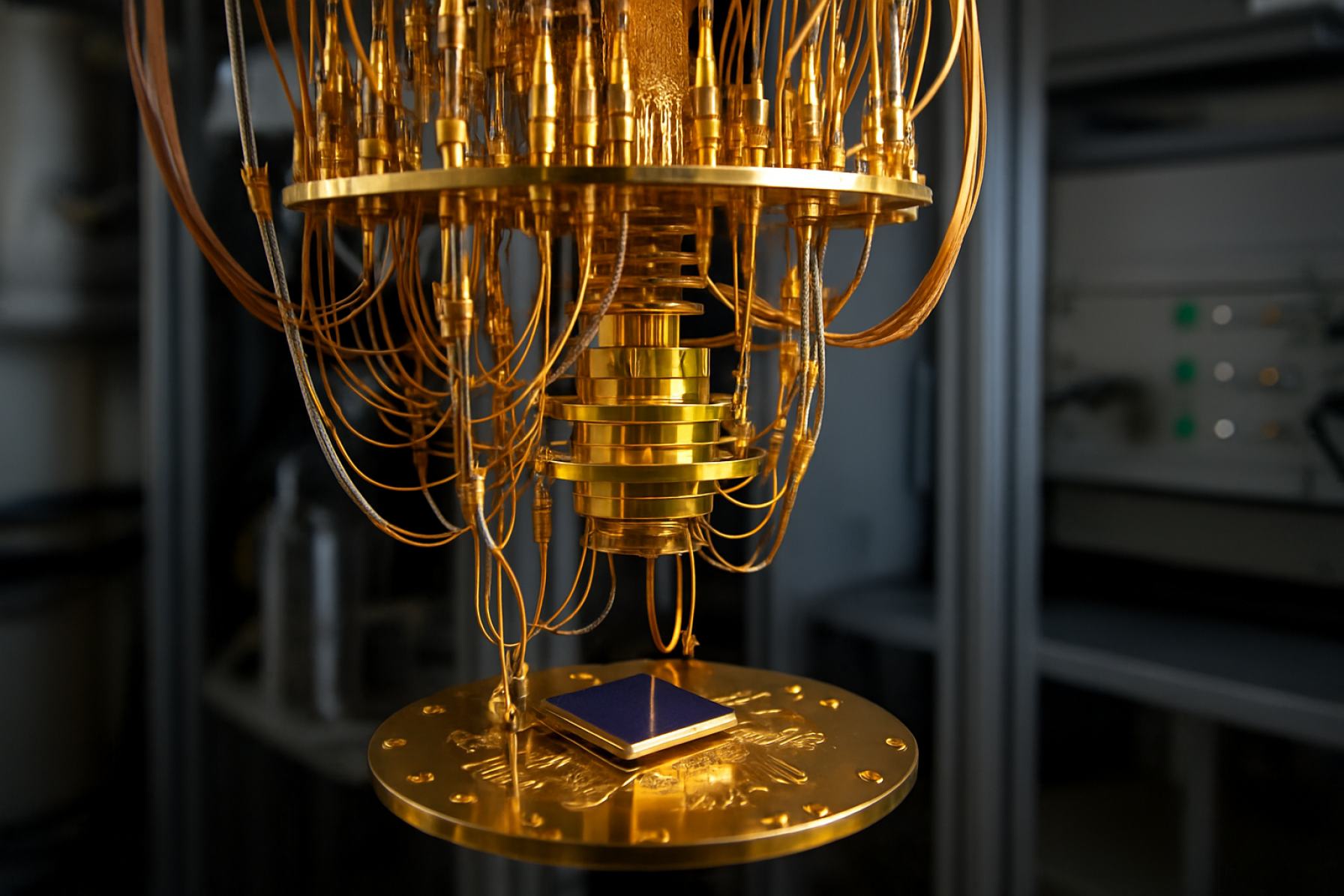

Superconducting qubits represent a leading architecture in the race toward practical quantum computing, leveraging the macroscopic quantum coherence of superconducting circuits to encode and manipulate quantum information. As of 2025, research into superconducting qubits is at the forefront of both academic and commercial quantum technology development, driven by their scalability, relatively mature fabrication techniques, and compatibility with existing semiconductor infrastructure.

The global superconducting qubits research landscape is characterized by intense competition among major technology companies, startups, and research institutions. Key players such as IBM, Google Quantum AI, and Rigetti Computing have made significant strides in increasing qubit coherence times, gate fidelities, and system integration. For instance, IBM’s 2024 roadmap outlined the deployment of 1,121-qubit processors, with a focus on error mitigation and modular scaling, while Google continues to refine its Sycamore architecture, targeting quantum error correction and logical qubit demonstrations.

According to International Data Corporation (IDC), the quantum computing market—including hardware, software, and services—is projected to surpass $8.6 billion by 2027, with superconducting qubits accounting for a substantial share of hardware investments. The technology’s appeal lies in its rapid gate operations (on the order of nanoseconds), established microfabrication processes, and the ability to integrate hundreds of qubits on a single chip. However, challenges remain, particularly in scaling to thousands of error-corrected qubits and reducing the overhead of cryogenic infrastructure.

Academic research continues to push the boundaries of coherence and control. Notable advances in 2024 included the demonstration of improved transmon qubit designs, novel materials for reduced decoherence, and the first multi-qubit logical operations with error rates below 1%. Collaborative efforts, such as the Quantum Economic Development Consortium (QED-C) and the U.S. National Quantum Initiative, are fostering public-private partnerships to accelerate progress and standardize benchmarks.

In summary, superconducting qubits research in 2025 is marked by rapid technological progress, robust investment, and a clear trajectory toward fault-tolerant quantum computing. The sector’s momentum is expected to continue, underpinned by both foundational scientific advances and growing commercial interest.

Key Technology Trends in Superconducting Qubits (2025–2030)

Superconducting qubits remain at the forefront of quantum computing research in 2025, with significant advancements shaping the trajectory toward practical, large-scale quantum processors. The field is characterized by rapid innovation in qubit coherence, error mitigation, and scalable architectures, driven by both academic and industry-led initiatives.

One of the most notable trends is the continued improvement in qubit coherence times. Researchers are leveraging new materials, such as tantalum and niobium-based alloys, to reduce decoherence and energy loss, extending the operational window for quantum computations. For instance, recent studies have demonstrated that tantalum-based transmons can achieve coherence times exceeding 0.5 milliseconds, a substantial leap from previous generations Nature.

Another key area of focus is the development of error-corrected logical qubits. In 2025, leading research groups are implementing surface code architectures and exploring bosonic codes to suppress error rates below the so-called “fault-tolerance threshold.” This progress is essential for scaling quantum processors beyond the noisy intermediate-scale quantum (NISQ) era. Companies such as IBM and Google Quantum AI are actively publishing results on multi-qubit error correction, with demonstrations of logical qubits that maintain fidelity over extended computational cycles.

Integration and scaling are also central to superconducting qubit research. Efforts are underway to develop three-dimensional (3D) integration techniques, enabling denser qubit arrays and more efficient interconnects. Innovations in cryogenic control electronics, such as those pioneered by Rigetti Computing and QuantWare, are reducing the complexity and thermal load of wiring, a critical bottleneck for scaling up to thousands of qubits.

Finally, hybrid approaches are gaining traction, with researchers exploring the coupling of superconducting qubits to other quantum systems, such as spin ensembles and photonic links. These hybrid systems aim to combine the fast gate speeds of superconducting circuits with the long-distance communication capabilities of photons, paving the way for distributed quantum computing architectures Nature.

Overall, superconducting qubit research in 2025 is marked by a convergence of material science, quantum error correction, and scalable engineering, setting the stage for the next generation of quantum processors.

Competitive Landscape and Leading Players

The competitive landscape for superconducting qubits research in 2025 is characterized by intense activity among leading technology companies, specialized quantum startups, and major academic institutions. Superconducting qubits remain the most commercially advanced and widely adopted architecture for quantum computing, driving significant investment and collaboration across the sector.

Key Industry Leaders

- IBM continues to be a dominant force, with its IBM Quantum program offering cloud-based access to superconducting quantum processors. In 2025, IBM’s roadmap targets the deployment of processors with over 1,000 qubits, leveraging advances in error mitigation and cryogenic engineering.

- Google Quantum AI maintains a leadership position, building on its 2019 quantum supremacy demonstration. Google’s Sycamore and subsequent processors focus on scaling qubit numbers and improving gate fidelities, with ongoing research into error correction and quantum advantage for practical applications.

- Rigetti Computing is a prominent startup specializing in modular superconducting qubit architectures. In 2025, Rigetti emphasizes hybrid quantum-classical workflows and partnerships with enterprise clients, aiming to commercialize quantum computing for optimization and machine learning tasks.

- Oxford Quantum Circuits (OQC) leads in the UK and Europe, focusing on scalable, low-error superconducting qubit systems. OQC’s innovations in 3D architecture and cryogenic integration are attracting both public and private investment.

Academic and Government Initiatives

- National Institute of Standards and Technology (NIST) and leading universities such as MIT and Stanford University are at the forefront of fundamental research, focusing on materials science, coherence time improvements, and novel qubit designs.

- European consortia, including Quantum Flagship, foster collaboration between academia and industry, accelerating the development of scalable superconducting qubit platforms.

Market Dynamics

The competitive landscape is shaped by rapid technological progress, strategic partnerships, and a race to achieve fault-tolerant quantum computing. Companies are differentiating through proprietary chip designs, software ecosystems, and cloud-based quantum services. According to IDC, the global quantum computing market is projected to grow at a CAGR of over 30% through 2025, with superconducting qubits research attracting the largest share of venture capital and government funding.

Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

The global superconducting qubits research market is poised for robust growth between 2025 and 2030, driven by escalating investments in quantum computing and increasing collaborations between academia, government, and industry. Superconducting qubits, which leverage the quantum properties of superconducting circuits, are at the forefront of quantum hardware development due to their scalability and compatibility with existing semiconductor fabrication techniques.

According to projections by International Data Corporation (IDC), the quantum computing market—including hardware, software, and services—is expected to surpass $8.6 billion by 2027, with superconducting qubits representing a significant share of hardware investments. The annual compound growth rate (CAGR) for the superconducting qubits research segment is estimated to be between 28% and 33% from 2025 to 2030, outpacing the broader quantum computing sector due to rapid advancements and increased funding rounds.

Key market drivers include:

- Substantial R&D funding from governments in the US, EU, and China, with initiatives such as the National Quantum Initiative and the EU Quantum Flagship allocating billions to quantum research, much of which is directed toward superconducting qubit technologies.

- Private sector investments led by major technology firms like IBM, Google, and Rigetti Computing, all of which have announced aggressive roadmaps for scaling up superconducting qubit systems.

- Growing demand for quantum computing solutions in pharmaceuticals, materials science, and financial modeling, which is accelerating the pace of superconducting qubit research and commercialization.

Regionally, North America is expected to maintain its leadership position, accounting for over 45% of global superconducting qubits research spending by 2025, followed by Europe and Asia-Pacific. The Asia-Pacific region, particularly China and Japan, is projected to experience the fastest CAGR, driven by national quantum strategies and increased venture capital activity.

In summary, the superconducting qubits research market is set for exponential growth through 2030, underpinned by technological breakthroughs, strategic investments, and expanding application domains. The sector’s CAGR is anticipated to remain above 30% for much of the forecast period, reflecting both the nascent stage and the transformative potential of superconducting quantum technologies.

Regional Market Analysis: North America, Europe, Asia-Pacific & Rest of World

The global landscape for superconducting qubits research in 2025 is marked by significant regional differentiation, with North America, Europe, Asia-Pacific, and the Rest of World each exhibiting unique strengths and strategic priorities.

North America remains the epicenter of superconducting qubits research, driven by robust investments from both the public and private sectors. The United States, in particular, leads with major initiatives from technology giants such as IBM, Google, and Rigetti Computing, all of which have made substantial progress in scaling up qubit numbers and improving coherence times. Federal funding through agencies like the U.S. Department of Energy and the National Science Foundation continues to underpin academic and industrial collaborations, fostering a vibrant ecosystem for quantum hardware innovation. Canada also plays a notable role, with institutions such as the Perimeter Institute and D-Wave Systems contributing to foundational research and commercialization efforts.

Europe is characterized by a coordinated, multi-national approach, exemplified by the Quantum Flagship program, which allocates significant funding to superconducting qubits projects across member states. Leading research centers in Germany, the Netherlands, and Switzerland—such as ETH Zurich and TU Delft—are at the forefront of developing scalable quantum processors and error correction techniques. European industry players, including SeeQC and Bosch, are increasingly active in integrating superconducting qubits into commercial applications, supported by strong public-private partnerships.

- Asia-Pacific is rapidly closing the gap, with China and Japan making strategic investments in superconducting qubits. Chinese institutions such as the University of Science and Technology of China have achieved notable milestones, including demonstrations of quantum supremacy. Japan’s RIKEN and NTT are also advancing device fabrication and quantum control technologies, often in collaboration with global partners.

- Rest of World regions, including Australia and Israel, are emerging as innovation hubs. Australia’s University of Sydney and Israel’s Weizmann Institute of Science are recognized for their contributions to quantum error correction and hybrid quantum systems, supported by targeted government funding and international collaborations.

Overall, the regional dynamics in 2025 reflect a competitive yet collaborative global environment, with each region leveraging its unique strengths to advance superconducting qubits research and commercialization.

Future Outlook: Emerging Applications and Investment Hotspots

Looking ahead to 2025, the landscape for superconducting qubits research is poised for significant evolution, driven by both technological breakthroughs and strategic investments. Superconducting qubits remain at the forefront of quantum computing due to their scalability, relatively mature fabrication processes, and compatibility with existing semiconductor infrastructure. As the race to achieve quantum advantage intensifies, several emerging applications and investment hotspots are shaping the future trajectory of this field.

One of the most promising application areas is quantum error correction, which is essential for building fault-tolerant quantum computers. In 2025, research is expected to focus on implementing more robust error-correcting codes and logical qubits, with leading players such as IBM and Rigetti Computing investing heavily in this direction. These advancements are critical for scaling up quantum processors and enabling practical quantum algorithms for chemistry, optimization, and cryptography.

Another emerging application is quantum simulation for materials science and pharmaceuticals. Superconducting qubits are particularly well-suited for simulating complex quantum systems, and collaborations between quantum hardware companies and industry leaders in chemicals and drug discovery are expected to intensify. For instance, Google Quantum AI has already demonstrated quantum supremacy and is now targeting real-world simulations that could revolutionize R&D pipelines.

From an investment perspective, hotspots are emerging in both established quantum hubs and new regions. The United States continues to lead, with significant funding from the U.S. Department of Energy and National Science Foundation supporting academic and private sector initiatives. In Europe, the Quantum Flagship program is channeling resources into superconducting qubit research, while China’s government-backed quantum initiatives are rapidly expanding their global footprint.

- Hybrid quantum-classical computing architectures are expected to gain traction, leveraging superconducting qubits for specific tasks within broader computational workflows.

- Startups focusing on cryogenic control electronics and quantum interconnects are attracting venture capital, as these technologies are vital for scaling superconducting qubit systems.

- Collaborative consortia between academia, industry, and government are accelerating the commercialization timeline, with pilot projects in finance, logistics, and cybersecurity anticipated by 2025.

Overall, the future outlook for superconducting qubits research in 2025 is characterized by a convergence of technical innovation, cross-sector collaboration, and targeted investment, setting the stage for the next wave of quantum-enabled applications and market growth.

Challenges, Risks, and Strategic Opportunities

Superconducting qubits remain at the forefront of quantum computing research, but the field faces a complex landscape of challenges, risks, and strategic opportunities as it moves into 2025. One of the primary technical challenges is improving qubit coherence times, which are still limited by material defects, environmental noise, and fabrication inconsistencies. Despite advances, decoherence remains a significant barrier to scaling up quantum processors, as even minor imperfections can lead to computational errors. Leading research groups and companies, such as IBM and Rigetti Computing, are investing heavily in materials science and error mitigation techniques to address these issues.

Another risk is the high cost and complexity of cryogenic infrastructure required to operate superconducting qubits at millikelvin temperatures. This not only increases capital expenditure but also limits accessibility for smaller research institutions and startups. Furthermore, the global supply chain for specialized components, such as dilution refrigerators and high-purity superconducting materials, remains vulnerable to disruptions, as highlighted during recent semiconductor shortages (McKinsey & Company).

Intellectual property (IP) risks are also intensifying. As the field matures, patent disputes and proprietary technology battles are becoming more common, potentially stifling collaboration and slowing innovation. The competitive landscape is further complicated by government investments and export controls, particularly in the US, EU, and China, which may restrict international partnerships and talent mobility (Nature).

Despite these challenges, strategic opportunities abound. The race to achieve quantum advantage—where quantum computers outperform classical systems in practical tasks—has spurred significant public and private investment. Collaborations between academia, industry, and government are accelerating the development of scalable quantum architectures. For example, National Science Foundation initiatives and partnerships with companies like Google Quantum AI are fostering innovation ecosystems that support both fundamental research and commercialization.

In summary, while superconducting qubits research in 2025 is fraught with technical, financial, and geopolitical risks, it also presents unique opportunities for those able to navigate the evolving landscape. Strategic investments in materials, infrastructure, and cross-sector collaboration will be critical to overcoming current barriers and unlocking the transformative potential of quantum computing.

Sources & References

- IBM

- Google Quantum AI

- Rigetti Computing

- International Data Corporation (IDC)

- Quantum Economic Development Consortium (QED-C)

- U.S. National Quantum Initiative

- Nature

- Oxford Quantum Circuits

- National Institute of Standards and Technology (NIST)

- MIT

- Stanford University

- Quantum Flagship

- National Quantum Initiative

- EU Quantum Flagship

- Perimeter Institute

- ETH Zurich

- TU Delft

- Bosch

- University of Science and Technology of China

- RIKEN

- University of Sydney

- Weizmann Institute of Science

- McKinsey & Company