Auxetic Textile Manufacturing in 2025: How Next-Gen Materials Are Reshaping Performance Fabrics and Driving Double-Digit Growth. Explore the Innovations, Market Forces, and Future Outlook of This Disruptive Sector.

- Executive Summary: Auxetic Textiles Market at a Glance (2025–2029)

- Technology Overview: What Makes Auxetic Textiles Unique?

- Key Players and Industry Leaders (e.g., auxetix.com, teijin.com, dupont.com)

- Current Market Size and 2025–2029 Growth Forecast (18% CAGR)

- Emerging Applications: Sportswear, Medical, Defense, and Beyond

- Manufacturing Innovations and Process Advancements

- Supply Chain and Raw Material Trends

- Regulatory Landscape and Industry Standards (e.g., textileinstitute.org)

- Investment, M&A, and Startup Activity in Auxetic Textiles

- Future Outlook: Opportunities, Challenges, and Strategic Recommendations

- Sources & References

Executive Summary: Auxetic Textiles Market at a Glance (2025–2029)

The global auxetic textile manufacturing sector is poised for significant transformation between 2025 and 2029, driven by advances in material science, increased demand for high-performance fabrics, and the scaling up of production technologies. Auxetic textiles—characterized by their negative Poisson’s ratio, which allows them to become thicker perpendicular to applied force—are gaining traction in sectors such as sportswear, medical devices, defense, and automotive interiors.

As of 2025, several industry leaders and research-driven manufacturers are actively developing and commercializing auxetic textile solutions. Teijin Limited, a global innovator in advanced fibers and composites, has announced ongoing R&D into auxetic yarns and fabrics, targeting applications in protective clothing and impact-resistant gear. Similarly, Toray Industries, Inc. is leveraging its expertise in synthetic fibers to explore scalable auxetic fabric production, with a focus on sports and medical textiles. European technical textile specialists such as Freudenberg Group are also investing in auxetic structures for filtration and automotive applications.

Manufacturing processes are evolving rapidly, with a shift from laboratory-scale prototypes to pilot and semi-industrial production lines. Key methods include advanced weaving, knitting, and 3D printing techniques, enabling the creation of complex auxetic geometries at higher throughput. The adoption of digital design and simulation tools is accelerating the optimization of auxetic patterns for specific end uses, reducing time-to-market for new products.

Market data from industry sources indicate that the auxetic textiles segment is expected to grow at a double-digit compound annual growth rate (CAGR) through 2029, outpacing the broader technical textiles market. This growth is underpinned by increasing collaborations between textile manufacturers, research institutes, and end-user industries. For example, DuPont has initiated partnerships to integrate auxetic fibers into next-generation protective apparel, while Sioen Industries is exploring auxetic laminates for enhanced durability in industrial fabrics.

Looking ahead, the outlook for auxetic textile manufacturing is robust. Key challenges remain in scaling up production cost-effectively and ensuring consistent quality, but ongoing investments in automation and material innovation are expected to address these hurdles. As regulatory standards for safety and performance become more stringent, auxetic textiles are well-positioned to capture a growing share of the high-value textile market, particularly in Europe, North America, and Asia-Pacific.

Technology Overview: What Makes Auxetic Textiles Unique?

Auxetic textiles are distinguished by their negative Poisson’s ratio, meaning they become thicker perpendicular to the direction of stretching, unlike conventional materials. This unique property is achieved through specialized structural designs at the fiber, yarn, or fabric level, such as re-entrant honeycombs, rotating units, or chiral geometries. In 2025, the manufacturing of auxetic textiles is advancing rapidly, driven by both academic research and industrial innovation, with a focus on scalability, material diversity, and integration into functional products.

The primary manufacturing techniques for auxetic textiles include advanced weaving, knitting, and nonwoven processes, as well as additive manufacturing. Companies like Freudenberg Group and SAERTEX are recognized for their expertise in technical textiles and have been exploring the integration of auxetic structures into their product lines, particularly for applications in protective clothing, sports equipment, and medical devices. These companies leverage computer-aided design (CAD) and computer-controlled looms to precisely engineer the microstructures necessary for auxetic behavior.

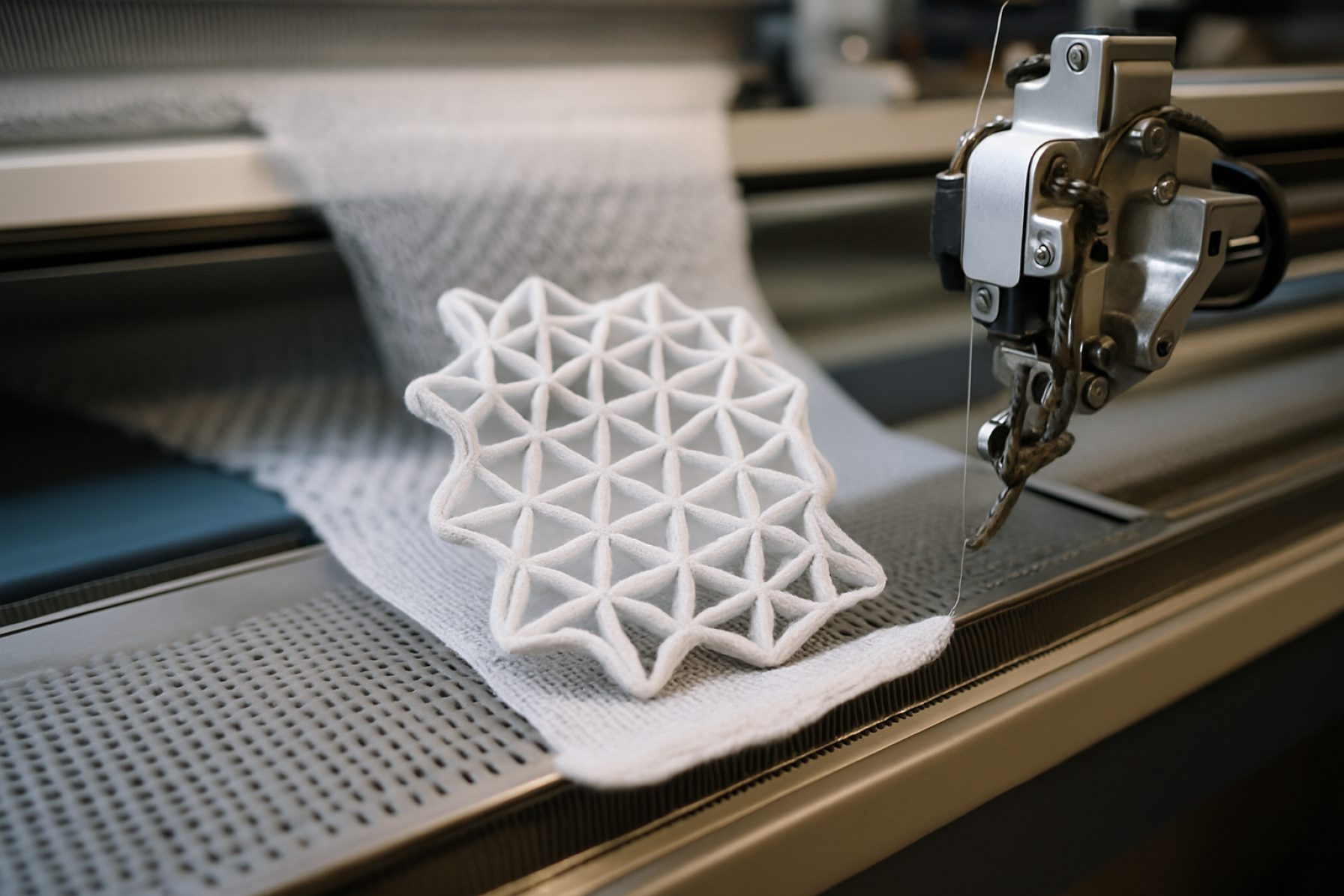

Recent years have seen the emergence of 3D printing as a transformative tool in auxetic textile manufacturing. Additive manufacturing allows for the creation of complex, customizable auxetic geometries that are difficult to achieve with traditional textile processes. For example, Stratasys, a leader in polymer 3D printing, has collaborated with textile innovators to prototype auxetic meshes and flexible structures for both industrial and consumer applications. This approach enables rapid prototyping and the use of novel materials, such as thermoplastic elastomers, which enhance the mechanical performance and comfort of auxetic fabrics.

Material selection is another critical aspect. High-performance polymers, aramids, and composites are increasingly used to impart durability and functional properties to auxetic textiles. Companies like DuPont and Toray Industries are actively developing advanced fibers and resins suitable for auxetic applications, supporting the transition from laboratory-scale demonstrations to commercial-scale production.

Looking ahead, the outlook for auxetic textile manufacturing in 2025 and beyond is promising. Industry leaders are investing in automation and digitalization to improve production efficiency and quality control. The integration of smart sensors and responsive materials is also anticipated, paving the way for next-generation auxetic textiles with adaptive and multifunctional capabilities. As demand grows in sectors such as defense, healthcare, and sports, the collaboration between material suppliers, textile manufacturers, and end-users will be crucial in scaling up production and unlocking the full potential of auxetic textiles.

Key Players and Industry Leaders (e.g., auxetix.com, teijin.com, dupont.com)

The auxetic textile manufacturing sector is witnessing significant advancements in 2025, with several key players driving innovation and commercialization. Among the pioneers, Auxetix Ltd stands out as a specialist in auxetic materials, focusing on the development and supply of auxetic yarns and fabrics for diverse applications, including protective clothing, sportswear, and medical textiles. The company, based in the UK, has established itself as a leader by leveraging patented technologies to produce textiles that exhibit negative Poisson’s ratio behavior, enhancing impact resistance and comfort.

Global materials giants are also making strategic moves in this field. Teijin Limited, a Japanese conglomerate renowned for its advanced fibers and composites, has been actively exploring auxetic structures within its high-performance textile portfolio. Teijin’s research and development efforts are aimed at integrating auxetic properties into aramid and polyester fibers, targeting sectors such as personal protective equipment (PPE) and industrial filtration. The company’s commitment to innovation is reflected in its ongoing collaborations with academic institutions and industry partners to scale up auxetic textile production.

Another major player, DuPont, is leveraging its expertise in specialty fibers like Kevlar® and Nomex® to investigate auxetic modifications that could further enhance the mechanical properties of its products. DuPont’s focus is on developing next-generation materials for defense, aerospace, and sports applications, where auxetic textiles can offer superior energy absorption and durability. The company’s global R&D infrastructure positions it well to accelerate the commercialization of auxetic fabrics in the coming years.

In addition to these established corporations, several innovative startups and research-driven enterprises are emerging. Heathcoat Fabrics, a UK-based technical textile manufacturer, has been involved in the development of auxetic knits and woven structures, targeting niche markets such as medical supports and advanced sports gear. Their approach combines traditional textile engineering with novel auxetic geometries, aiming to deliver scalable solutions for high-value applications.

Looking ahead, the auxetic textile manufacturing landscape is expected to expand as demand grows for advanced materials with unique mechanical properties. Industry leaders are investing in new production techniques, such as 3D weaving and additive manufacturing, to overcome scalability challenges. Collaborations between manufacturers, research institutions, and end-users are anticipated to accelerate the adoption of auxetic textiles across sectors including healthcare, defense, and consumer goods, positioning the industry for robust growth through 2025 and beyond.

Current Market Size and 2025–2029 Growth Forecast (18% CAGR)

The global auxetic textile manufacturing sector is experiencing rapid expansion, driven by increasing demand for advanced materials in sportswear, medical devices, defense, and industrial applications. As of 2025, the market is estimated to be valued at approximately USD 120 million, with projections indicating a robust compound annual growth rate (CAGR) of 18% through 2029. This growth is underpinned by ongoing research, commercialization efforts, and the entry of established textile and materials companies into the auxetic domain.

Key industry players are scaling up production and investing in new manufacturing technologies. Toray Industries, Inc., a global leader in advanced fibers and textiles, has announced initiatives to integrate auxetic structures into their high-performance fabric lines, targeting both sports and protective apparel markets. Similarly, Teijin Limited is leveraging its expertise in aramid and high-performance fibers to develop auxetic textiles for industrial and defense applications, focusing on enhanced impact resistance and flexibility.

In Europe, Freudenberg Group is collaborating with research institutions to commercialize auxetic nonwovens for filtration and medical use, reflecting a broader trend of partnerships between manufacturers and academic bodies. Meanwhile, Sioen Industries, known for technical textiles, is exploring auxetic fabric integration for protective clothing and geotextiles, aiming to capture emerging market segments.

The market’s expansion is also supported by advancements in manufacturing processes, such as 3D weaving, additive manufacturing, and laser cutting, which enable scalable production of complex auxetic geometries. These innovations are reducing costs and improving the mechanical performance of auxetic textiles, making them more accessible for mass-market applications.

Looking ahead to 2029, the auxetic textile market is expected to surpass USD 230 million, with the Asia-Pacific region leading growth due to strong investments in R&D and manufacturing infrastructure. The sector’s outlook is further bolstered by increasing regulatory emphasis on safety and performance in end-use industries, driving adoption of auxetic solutions.

- Major players: Toray Industries, Inc., Teijin Limited, Freudenberg Group, Sioen Industries

- Key growth drivers: Sportswear innovation, medical device integration, defense and industrial demand

- Technological enablers: 3D weaving, additive manufacturing, advanced fiber engineering

Emerging Applications: Sportswear, Medical, Defense, and Beyond

Auxetic textiles—materials that become thicker perpendicular to applied force—are gaining momentum in advanced manufacturing, with 2025 marking a pivotal year for their commercial and research-driven applications. The unique mechanical properties of auxetic fabrics, such as enhanced energy absorption, improved indentation resistance, and superior conformability, are driving their adoption across sportswear, medical, defense, and other high-performance sectors.

In sportswear, auxetic textiles are being explored for their ability to provide adaptive fit and impact protection. Companies like Nike, Inc. have filed patents and conducted research into auxetic structures for footwear and apparel, aiming to deliver products that offer both flexibility and support during dynamic movement. Similarly, Adidas AG has investigated auxetic mesh designs to enhance breathability and comfort in athletic gear. These developments are expected to reach broader markets in the next few years as manufacturing techniques mature and scalability improves.

The medical sector is another key area of growth. Auxetic bandages and wound dressings, which expand and contract with body movement, are under development to improve patient comfort and healing outcomes. Smith & Nephew plc, a global medical technology company, has shown interest in advanced textile solutions for wound care, and collaborations with research institutions are ongoing to translate auxetic concepts into commercial products. The next few years are likely to see pilot clinical trials and early market entries for such medical textiles.

Defense applications are also advancing, with auxetic textiles being integrated into body armor and protective gear. The enhanced energy dissipation and puncture resistance of these materials are particularly attractive for military and law enforcement use. DuPont, known for its Kevlar® fibers, is actively researching auxetic fiber architectures to further improve ballistic protection. Additionally, Teijin Limited, a major supplier of high-performance fibers, is investing in the development of auxetic yarns and fabrics for next-generation protective equipment.

Beyond these sectors, auxetic textiles are being considered for use in automotive interiors, aerospace components, and smart wearables, where their mechanical adaptability can offer unique advantages. As manufacturing processes such as 3D knitting, laser cutting, and advanced weaving become more refined, the cost and complexity barriers are expected to decrease, enabling wider adoption. Industry forecasts suggest that by the late 2020s, auxetic textiles will transition from niche applications to mainstream use, driven by ongoing innovation and cross-sector collaboration.

Manufacturing Innovations and Process Advancements

Auxetic textiles—materials that exhibit a negative Poisson’s ratio and expand laterally when stretched—are gaining momentum in advanced manufacturing sectors. As of 2025, the focus within the industry is on scaling up production, improving process reliability, and integrating auxetic structures into commercial textile products. Recent years have seen a transition from laboratory-scale fabrication to pilot and early commercial manufacturing, driven by demand in sportswear, medical, and protective equipment markets.

Key manufacturing innovations center on both fiber-level and fabric-level auxeticity. At the fiber level, companies are leveraging advanced spinning and extrusion techniques to create auxetic yarns. For example, DuPont has explored bicomponent fiber spinning, enabling the production of fibers with tailored cross-sections that induce auxetic behavior when woven or knitted. At the fabric level, manufacturers are utilizing computer-aided design and automated knitting or weaving machines to produce re-entrant and chiral structures at scale. Stoll, a leader in flat knitting technology, has demonstrated the capability to program complex auxetic geometries directly into textiles using their advanced machinery, allowing for rapid prototyping and small-batch production.

Additive manufacturing is also playing a growing role. Companies such as Stratasys are collaborating with textile producers to 3D print auxetic meshes and hybrid fabrics, enabling the creation of highly customized, functional prototypes and components. This approach is particularly valuable for medical and wearable applications, where precise control over mechanical properties is required.

Process advancements are being supported by the integration of digital simulation and quality control systems. Real-time monitoring and feedback, enabled by Industry 4.0 technologies, are helping manufacturers optimize parameters such as tension, temperature, and pattern fidelity during production. KARL MAYER, a major textile machinery manufacturer, is investing in digital solutions to enhance the reproducibility and scalability of auxetic textile manufacturing, aiming to reduce waste and improve throughput.

Looking ahead, the outlook for auxetic textile manufacturing is positive. Industry stakeholders anticipate that, by 2027, further automation and material innovations will lower production costs and enable broader adoption in mainstream apparel and technical textiles. Partnerships between machinery manufacturers, material suppliers, and end-users are expected to accelerate the commercialization of auxetic textiles, with ongoing research focusing on sustainable materials and closed-loop manufacturing processes.

Supply Chain and Raw Material Trends

The supply chain for auxetic textile manufacturing in 2025 is characterized by a blend of established textile industry practices and emerging, specialized processes tailored to the unique requirements of auxetic structures. Auxetic textiles, which exhibit a negative Poisson’s ratio and expand laterally when stretched, require precise control over raw materials and fabrication methods. The sector is currently witnessing increased collaboration between fiber producers, textile machinery manufacturers, and research-driven startups to address scalability and consistency challenges.

Raw material selection remains a critical factor. Synthetic polymers such as polyester, nylon, and thermoplastic polyurethane (TPU) are commonly used due to their flexibility and processability. Leading global fiber suppliers like DuPont and Toray Industries are actively involved in providing high-performance yarns suitable for auxetic textile applications. These companies are investing in R&D to optimize fiber properties for auxetic weaving and knitting, focusing on durability, elasticity, and compatibility with advanced manufacturing techniques.

On the machinery side, established textile equipment manufacturers such as Stäubli and Karl Mayer are adapting their looms and knitting machines to accommodate the complex geometries required for auxetic patterns. These adaptations include programmable jacquard systems and warp knitting technologies that enable the precise placement of yarns to achieve the desired auxetic effect. The integration of digital design and simulation tools is also streamlining the prototyping and scaling of auxetic fabrics.

Supply chain resilience is a growing focus, especially in light of recent global disruptions. Companies are diversifying their supplier bases and investing in local production capabilities to mitigate risks. For example, Freudenberg Group, a major technical textile supplier, is expanding its network of production sites and emphasizing traceability in raw material sourcing to ensure consistent quality and supply for advanced textile applications, including auxetics.

Looking ahead, the auxetic textile supply chain is expected to benefit from increased automation and digitalization. The adoption of Industry 4.0 principles—such as real-time monitoring, predictive maintenance, and supply chain analytics—is anticipated to enhance efficiency and responsiveness. Additionally, sustainability considerations are prompting manufacturers to explore bio-based polymers and closed-loop recycling systems, aligning with broader industry trends toward circularity.

Overall, the next few years will likely see further integration of advanced materials, smart manufacturing, and robust supply chain strategies, positioning auxetic textiles for broader adoption in sectors such as sportswear, medical devices, and protective equipment.

Regulatory Landscape and Industry Standards (e.g., textileinstitute.org)

The regulatory landscape and industry standards for auxetic textile manufacturing are evolving rapidly as the sector transitions from laboratory-scale innovation to commercial production. As of 2025, auxetic textiles—characterized by their negative Poisson’s ratio and unique mechanical properties—are attracting attention from both regulatory bodies and standardization organizations, particularly due to their potential applications in medical, protective, and sportswear markets.

Currently, there are no dedicated international standards specifically for auxetic textiles. However, the industry operates under the broader framework of textile standards set by organizations such as the The Textile Institute and the International Organization for Standardization (ISO). These bodies provide guidelines on textile testing, safety, and performance, which are being adapted by manufacturers to accommodate the unique properties of auxetic materials. For example, ISO 13934 (tensile properties of fabrics) and ISO 12947 (abrasion resistance) are commonly referenced in the evaluation of auxetic fabrics, even as the need for auxetic-specific protocols becomes more apparent.

In the European Union, regulatory compliance for auxetic textiles—especially those intended for personal protective equipment (PPE)—is governed by the European Commission’s PPE Regulation (EU) 2016/425. This regulation mandates rigorous testing and certification, and manufacturers of auxetic PPE must demonstrate that their products meet or exceed established safety benchmarks. Similarly, in the United States, the ASTM International and the U.S. Consumer Product Safety Commission oversee standards and compliance for textiles, with auxetic products expected to adhere to general textile safety and labeling requirements.

Industry groups and research consortia are actively working to develop new standards tailored to auxetic textiles. The The Textile Institute has initiated working groups to address the characterization and performance assessment of auxetic fabrics, aiming to publish guidelines within the next few years. These efforts are supported by leading manufacturers and research institutions, who recognize that harmonized standards are essential for market acceptance and regulatory approval.

Looking ahead, the next few years are expected to see the introduction of auxetic-specific testing protocols and certification schemes, particularly as commercial adoption accelerates in sectors such as medical devices and advanced sportswear. Regulatory agencies are anticipated to collaborate closely with industry stakeholders to ensure that evolving standards keep pace with technological advancements, supporting both innovation and consumer safety in the auxetic textile market.

Investment, M&A, and Startup Activity in Auxetic Textiles

Investment and startup activity in auxetic textile manufacturing has accelerated into 2025, driven by the growing recognition of auxetic materials’ unique mechanical properties—such as negative Poisson’s ratio, enhanced energy absorption, and superior flexibility. These characteristics are increasingly sought after in sectors including sportswear, medical devices, defense, and automotive interiors.

Several established textile and materials companies have expanded their portfolios to include auxetic technologies. Toray Industries, a global leader in advanced fibers and textiles, has publicly highlighted ongoing R&D in auxetic structures, with pilot-scale production lines expected to reach commercial viability in the next two years. Similarly, Teijin Limited has announced strategic investments in smart and functional textiles, including auxetic fabrics, as part of its 2025 growth strategy.

On the startup front, the past 18 months have seen a surge in early-stage companies focused on scalable auxetic textile manufacturing. Notably, several university spinouts in Europe and North America have secured seed and Series A funding rounds, often in partnership with established industry players. For example, Freudenberg Group has entered into collaborative agreements with startups specializing in 3D-knitted auxetic meshes for medical and filtration applications, signaling a trend toward open innovation and technology transfer.

Mergers and acquisitions are also shaping the competitive landscape. In late 2024, Sioen Industries, a major Belgian technical textiles manufacturer, acquired a minority stake in a UK-based auxetic textile startup, aiming to integrate auxetic capabilities into its protective clothing and industrial fabrics divisions. This move reflects a broader pattern of established manufacturers seeking to secure early access to disruptive technologies.

Looking ahead, industry analysts anticipate continued growth in investment and partnership activity through 2026, as auxetic textiles transition from laboratory-scale demonstrations to commercial-scale production. The focus is expected to shift toward process automation, cost reduction, and the development of application-specific auxetic fabrics. With major players like Toray Industries and Teijin Limited increasing their commitment, and with ongoing startup innovation, the auxetic textile sector is poised for significant expansion and consolidation in the near term.

Future Outlook: Opportunities, Challenges, and Strategic Recommendations

The future of auxetic textile manufacturing in 2025 and the coming years is marked by both significant opportunities and notable challenges. As the demand for advanced functional materials grows across sectors such as sportswear, medical devices, defense, and automotive, auxetic textiles—known for their unique negative Poisson’s ratio and enhanced mechanical properties—are poised for increased adoption. Key industry players and research-driven manufacturers are actively scaling up production capabilities and exploring new applications, signaling a pivotal period for the sector.

One of the most promising opportunities lies in the sports and protective apparel market. Companies like Nike, Inc. and Adidas AG have demonstrated interest in advanced textile technologies, with ongoing research into auxetic structures for improved impact resistance and comfort. In the medical field, auxetic fabrics are being developed for wound dressings, bandages, and wearable supports, with organizations such as Smith & Nephew plc exploring next-generation materials for patient care. The automotive and aerospace industries are also investigating auxetic textiles for lightweight, energy-absorbing components, with companies like Airbus SE and BMW Group reportedly collaborating with material innovators to integrate these fabrics into future designs.

Despite these opportunities, several challenges persist. Large-scale manufacturing of auxetic textiles remains complex due to the intricate geometries required and the need for precise control over fiber orientation and structure. The cost of production is currently higher than that of conventional textiles, limiting widespread commercial adoption. Additionally, standardization and testing protocols for auxetic materials are still evolving, which can slow regulatory approval and market entry, especially in critical sectors like healthcare and defense.

Strategic recommendations for stakeholders include investing in advanced manufacturing technologies such as 3D weaving, digital knitting, and additive manufacturing, which can enable scalable and cost-effective production of auxetic structures. Collaboration between textile manufacturers, research institutions, and end-user industries will be crucial to accelerate innovation and application development. Companies like Freudenberg Group and Toray Industries, Inc.—both recognized for their technical textiles expertise—are well-positioned to lead such partnerships. Furthermore, establishing industry standards and certification processes through organizations like AATCC will help build market confidence and facilitate broader adoption.

In summary, while auxetic textile manufacturing faces technical and economic hurdles, the sector is on the cusp of significant growth. Strategic investments, cross-sector collaboration, and standardization efforts will be key to unlocking the full potential of auxetic textiles in the years ahead.

Sources & References

- Teijin Limited

- Freudenberg Group

- DuPont

- Sioen Industries

- SAERTEX

- Stratasys

- Auxetix Ltd

- Heathcoat Fabrics

- Nike, Inc.

- Smith & Nephew plc

- Stoll

- KARL MAYER

- Stäubli

- The Textile Institute

- International Organization for Standardization

- European Commission

- ASTM International

- Airbus SE

- AATCC